Since its inception in 2014, CapDeck has been a pivotal support of CapDeck Business Loans for numerous American businesses, aiding them in establishing a strong foundation.

Their mission extends beyond merely providing financial assistance; they are dedicated to fostering business growth and enhancing customer service.

With their experienced team, they strive to expedite the funding and expansion process for your business.

Guide to securing CapDeck Business Loans up to $500,000

1. Focus on Your Strengths:

CapDeck encourages business owners to concentrate on their core competencies. They understand that your expertise lies in running your business, and we are here to handle the intricacies of securing business finance.

2. Streamlined Process:

Their team ensures a quick and efficient process. By following simple steps, you can receive a funding offer promptly, allowing you to address your business needs without unnecessary delays.

3. Comprehensive Support:

Beyond financial assistance, CapDeck offers comprehensive support to help your business thrive. Whether it’s strategic guidance, market insights, or growth planning, we are committed to assisting you at every stage of your business journey.

4. Tailored Solutions:

They recognize that each business is unique. Their approach involves understanding your specific needs and customizing funding solutions accordingly. This ensures that you receive the support that aligns with your business goals.

5. Humor-Infused Content:

While conveying our message, They inject a touch of humor into the information. Just as many variations exist in Lorem Ipsum, they appreciate the diversity in businesses and aim to make the financial process a bit more engaging and enjoyable.

Why Choose CapDeck Loan

Choosing a CapDeck loan offers a multitude of benefits that set us apart in the financial landscape. Here’s why CapDeck stands out as your ideal choice:

Effortless Process for Quick Results:

CapDeck truly values the importance of time in the business world. Their loan application process is a beacon of efficiency, ensuring a swift and hassle-free experience. No more drowning in paperwork or enduring delays CapDeck prioritizes getting you the funds you need promptly.

Tailored Funding Options for Diverse Needs:

The beauty of CapDeck lies in its understanding of the diverse needs of businesses. They offer a range of funding options, all tailored to suit your specific requirements. Whether it’s working capital, equipment financing, or expansion capital, CapDeck has you covered.

Generous Funding Limits for Growth:

CapDeck doesn’t just provide funds; they empower your growth. With substantial funding limits, you have the potential to receive up to $500,000 for your business. This generous allowance provides the financial flexibility essential for fueling growth and achieving business objectives.

Partners in Success with Expert Guidance:

CapDeck is more than a lending service; they’re true partners in your success. Their team offers expert guidance and support throughout your business journey. Beyond providing funds, they share valuable insights and strategic advice, empowering you to make informed decisions.

Transparent and Fair Terms:

Transparency is the hallmark of CapDeck’s operations. When dealing with them, you can trust that the terms and conditions of your loan are clear and straightforward. No hidden fees or surprises—just a transparent partnership focused on the prosperity of your business.

Customer-Centric Excellence:

CapDeck prioritizes your satisfaction with a customer-centric approach. They take the time to understand your needs and ensure they are met. The goal is not just a transaction but building lasting relationships that contribute to the long-term success of your business.

Adaptable Innovation for Business Evolution:

CapDeck doesn’t rest on its laurels. They continually evolve to meet the ever-changing needs of businesses. Their pride lies in offering innovative financial solutions that seamlessly adapt to the dynamic business landscape. With CapDeck, you stay ahead with a partner that embraces creativity and adaptability.

CapDeck Business Loans vs. Banks Business Loan

| Features | Banks | CapDeck |

| Approvals within hours | ||

| Funds the next day | ||

| Renewable source of funds | ||

| No personal collateral or assets | ||

| Minimal paperwork |

CapDeck Business Loans And Financing

In a world where every business has its unique needs, finding the right financial solution is crucial. CapDeck understands this and offers short-term funding solutions tailored to the diverse needs of businesses.

They get that the path to satisfaction depends on the business model, and they’re right there with you, providing the funds needed for growth and seizing new opportunities.

What sets CapDeck apart is their unwavering commitment to giving business owners access to the capital they need precisely when they need it.

Unlike traditional lending models that often fall short for small businesses, CapDeck’s approach is refreshingly different. They don’t just provide loans; it’s more like a business funding process designed to cater specifically to the unique challenges faced by small businesses.

Say goodbye to the frustrating experience of dealing with maxed-out credit cards and drowning in paperwork only to face rejection from your bank.

CapDeck makes it simple. You apply, and their account representatives guide you seamlessly through their proprietary underwriting process to secure the funds your business requires.

It’s a breath of fresh air compared to the conventional lending hoops.

What I appreciate most about CapDeck is their forward-looking approach. They aren’t overly concerned with your business’s past; instead, they focus on what your business can achieve.

It’s this perspective that makes them an invaluable partner in the journey of business growth.

How to Apply for Capdeck Business Loan

Applying for a CapDeck business loan is a straightforward process designed with your convenience in mind. Here’s a step-by-step guide to help you navigate through the application process:

Step 1: Visit the CapDeck Website Start by visiting the official CapDeck website. Navigate to the business loan section, where you’ll find detailed information about the types of loans they offer and the application process.

Step 2: Learn About CapDeck’s Offerings Familiarize yourself with the various business loan options provided by CapDeck. Whether you need short-term funding, working capital, equipment financing, or expansion capital, understanding your business’s specific needs will help you choose the right loan product.

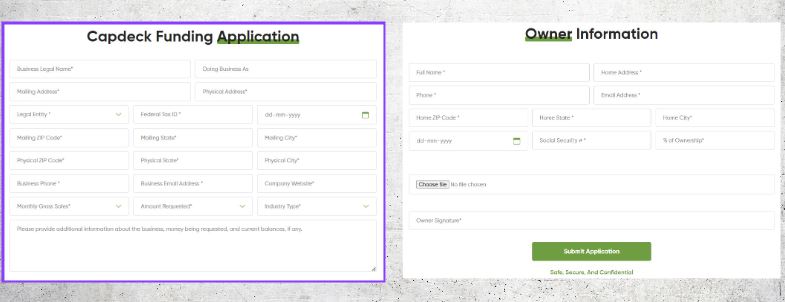

Step 3: Click on “Apply Now” Once you’ve identified the loan type that suits your requirements, look for the “Apply Now” button on the CapDeck website. This will likely redirect you to the online application form.

Step 4: Complete the Online Application Form The online application form will require essential information about your business, such as your business name, industry, revenue, and the purpose of the loan. Be prepared to provide accurate and up-to-date details to expedite the process.

Step 5: Submit Required Documentation After completing the initial application, CapDeck may request supporting documentation to assess your business’s financial health. This may include bank statements, financial statements, and other relevant documents. Ensure you have these ready for submission.

Step 6: Undergo the Proprietary Underwriting Process CapDeck employs a proprietary underwriting process to evaluate your business’s eligibility for a loan. During this stage, their account representatives may reach out to you for additional information or clarification.

Step 7: Receive a Funding Offer Once your application has been thoroughly reviewed, CapDeck will provide you with a funding offer. This offer will detail the approved loan amount, terms, and conditions. Take the time to review this carefully.

Step 8: Accept the Offer If you’re satisfied with the funding offer, proceed to accept it. This may involve electronically signing the necessary documents to formalize the agreement.

Step 9: Receive Funds After accepting the offer and completing any remaining paperwork, CapDeck will initiate the fund disbursement. Depending on the specifics of your loan, the funds could be deposited directly into your business account.

Step 10: Utilize Funds for Business Growth Congratulations! With the funds now in your account, you can use them to address your business needs, whether it’s expansion, working capital, or other purposes.

Remember, throughout the entire process, CapDeck’s team is there to assist and guide you. If you have any questions or need clarification at any step, don’t hesitate to reach out to their customer support. Applying for a CapDeck business loan is a seamless experience tailored to support the success and growth of your business.

Conclusion

CapDeck Business Loans emerges as a dynamic and reliable partner for entrepreneurs navigating the complex landscape of business financing. With its innovative approach, streamlined processes, and commitment to empowering small and medium-sized enterprises, CapDeck stands out as a beacon of support in the competitive business world. Whether you are a budding startup seeking initial capital or an established business aiming for expansion, CapDeck’s flexible loan options and personalized service make it a standout choice. As we wrap up our exploration of CapDeck Business Loans, it’s evident that this financial solution is not merely about providing funds but fostering a lasting partnership to fuel the growth and success of businesses. With CapDeck, the journey to achieving your business aspirations becomes not just attainable, but also remarkably efficient and rewarding.