Tax Concept | What is Tax | Types of Taxes | Recent Reforms in Taxes | What is Income Tax?

Taxation is a fundamental aspect of governance, yet many find the concept complex and daunting. Have you ever wondered why governments collect taxes and how recent reforms have shaped our financial landscape?

Understanding the nature of taxes and the latest changes in tax laws is crucial for every citizen.At its core, tax is a financial charge imposed by the government on individuals and businesses to fund public services.

Recent reforms have focused on simplifying tax structures and improving compliance, aiming to create a fairer and more efficient system.

This article delves into these reforms and explains how they impact taxpayers.But there’s more to discover beyond these basics. Explore how recent updates have transformed tax policies and what it means for your financial planning.

Stay informed and navigate the evolving tax landscape with ease!

What is Tax: Direct and Indirect

A tax is a compulsory financial charge the government imposes on individuals or organizations. Tax revenue is used to fund public services and infrastructure projects.

These funds are essential for maintaining and improving the facilities that serve the public. Failure to pay taxes can lead to serious legal consequences as outlined by the law.

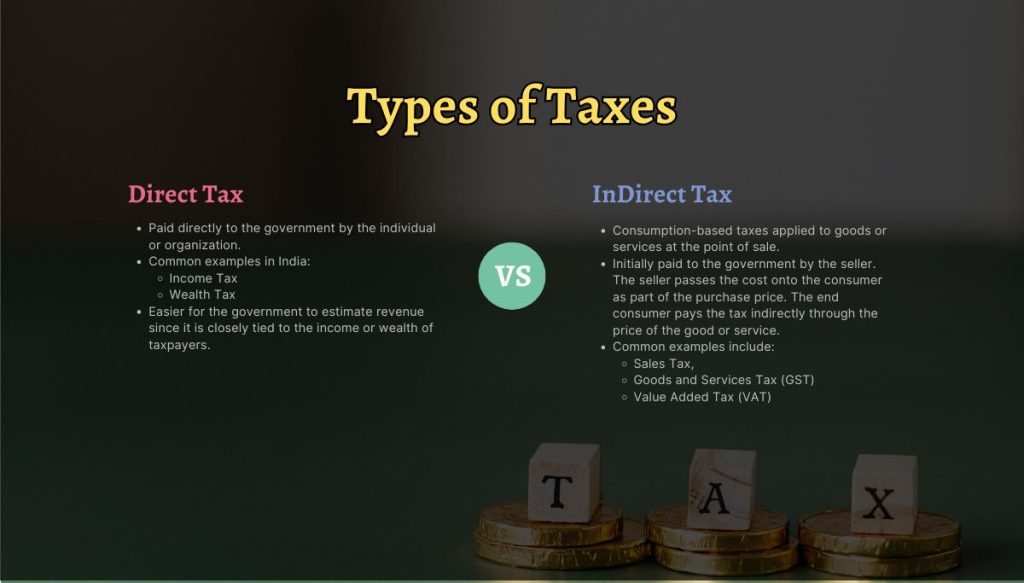

Both individuals and businesses are required to pay taxes in various forms. These taxes are broadly classified into two categories: direct taxes and indirect taxes. Let’s explore each type in more detail.

Direct Tax

- Paid directly to the government by the individual or organization.

- Common examples in India:

- Income Tax

- Wealth Tax

- Easier for the government to estimate revenue since it is closely tied to the income or wealth of taxpayers.

Indirect Tax

- Consumption-based taxes applied to goods or services at the point of sale.

- Initially paid to the government by the seller. The seller passes the cost onto the consumer as part of the purchase price. The end consumer pays the tax indirectly through the price of the good or service.

- Common examples include:

- Sales Tax

- Goods and Services Tax (GST)

- Value Added Tax (VAT)

| Criteria | Direct Tax | Indirect Tax |

|---|---|---|

| Definition | Tax directly levied on individuals or companies by the government. | Tax levied on goods and services rather than on income or profits. |

| Nature | Progressive (based on ability to pay). | Regressive (same rate for everyone). |

| Basis of Taxation | Income, profits, and capital gains. | Consumption, sales, and services. |

| Collection | Collected directly from taxpayers. | Collected from consumers by intermediaries (e.g., businesses). |

| Example | Income Tax, Corporate Tax. | GST, Customs Duty, Excise Duty. |

| Impact | Directly affects the disposable income of individuals and profits of businesses. | Indirectly affects the prices of goods and services, impacting consumers. |

| Ease of Collection | Generally more challenging due to the need to assess and verify income sources. | Generally easier due to point-of-sale collection mechanisms. |

| Equity | More equitable as it’s based on ability to pay. | May be less equitable as it affects everyone, regardless of income level. |

India’s Tax Reforms

India has been on a consistent journey of tax reforms to create a more efficient and taxpayer-friendly environment.

The government’s focus on digitalization, ease of compliance, and boosting economic growth has led to several significant changes in recent years.

The Goods and Services Tax (GST) Revolution

One of the most significant tax reforms in India has been the implementation of the Goods and Services Tax (GST). Introduced in 2017, GST subsumed multiple indirect taxes, creating a unified national market. Key benefits of GST include:

- Simplified tax structure: Reducing the compliance burden for businesses.

- Increased tax revenue: By broadening the tax base and reducing tax evasion.

- Improved logistics efficiency: Streamlining the movement of goods across state borders.

Income Tax Reforms

The income tax regime has also undergone several changes to make it more taxpayer-friendly. Key reforms include:

- New tax regime: Offering lower tax rates with fewer deductions.

- Increased tax slabs: Providing relief to taxpayers by adjusting income thresholds.

- Standard deduction: Simplifying tax calculations for salaried individuals.

- Faceless assessment: Reducing human interface to enhance transparency and efficiency.

- Digitalization: Promoting online filing, e-verification, and electronic payments.

Other Notable Reforms

- Corporate tax rate reductions: To attract investments and boost economic growth.

- Focus on ease of doing business: Simplifying procedures and reducing compliance costs.

While these reforms have been instrumental in improving the tax landscape, challenges such as GST rate rationalization and addressing the compliance burden for small businesses still persist.

What is Income Tax?

Income tax is a levy imposed by the government on the income earned by individuals or businesses. It’s a source of revenue for the government that funds public services and infrastructure development.

Who Needs to Pay Income Tax?

In India, any individual or entity whose taxable income exceeds the exemption limit set by the government is liable to pay income tax. This includes income from salaries, businesses, investments, capital gains, and other sources.

You May Like to Read: How to Become an Income Tax Officer

How is Income Tax Calculated?

Your income tax liability is determined based on your income slab. The government sets different tax rates for various income brackets.

The higher your income, the higher the tax rate you’ll be subject to. You can reduce your taxable income by claiming eligible deductions allowed under the Income Tax Act.

Tax Slabs and Deductions

The Income Tax Department of India categorizes taxpayers into different income slabs. Each slab has a specific tax rate applied to the income falling within that bracket.

Here’s a table outlining the tax slabs for individual taxpayers for the Assessment Year 2024-25 (Income earned in the financial year 2023-24):

| Income Slab (₹) | Tax Rate (%) |

|---|---|

| Up to 2,50,000 | Nil |

| 2,50,001 – 5,00,000 | 5 |

| 5,00,001 – 7,50,000 | 10 |

| 7,50,001 – 10,00,000 | 15 |

| 10,00,001 onwards | 30 |

*These are just the basic tax slabs. Surcharge and cess may apply depending on your income. It’s always recommended to consult a tax professional for personalized tax advice.

Common Tax Deductions Under Sections 80C, 80D, etc.

The Income Tax Act offers various deductions that can help you reduce your taxable income. Some popular deductions include:

- Section 80C: Investments in Public Provident Fund (PPF), Equity Linked Savings Scheme (ELSS) Mutual Funds, Unit Linked Insurance Plans (ULIPs), etc.

- Section 80D: Expenses on medical treatment for self, spouse, dependent parents, and children.

- Section 80G: Donations to charitable institutions.

Strategies to Save Tax Legally

There are various ways to save tax legally within the framework of the Income Tax Act. Here are some tips:

- Invest in tax-saving schemes offered under Section 80C and other relevant sections.

- Claim deductions for eligible expenses such as medical bills, educational expenses, and home loan interest.

- Plan your finances strategically to maximize deductions and minimize your tax burden.

Case Studies: Impact of Tax Reforms

To make the content more relatable, let’s look at some real-life examples of how tax reforms have impacted individuals and businesses.

Case Study 1: Small Business Owner

A small business owner benefited from the GST reforms through a simplified tax structure, reducing compliance costs and improving logistics efficiency. This allowed the business to expand its market reach and improve profitability.

Case Study 2: Salaried Employee

A salaried employee found the new income tax regime advantageous, with lower tax rates and fewer deductions simplifying tax calculations. The faceless assessment process also provided a more transparent and efficient experience.

Tax Planning Tips: Maximizing Your Savings

Effective tax planning can significantly reduce your tax liability and help you achieve your financial goals. While we’ve covered general tax-saving strategies, let’s delve deeper into specific tips to optimize your deductions and investments.

Optimizing Section 80C Investments

Section 80C offers a deduction of up to ₹1.5 lakhs per financial year. To maximize this benefit, consider the following:

- Diversification: Spread your investments across various options like PPF, ELSS, and NPS to reduce risk.

- Long-term Perspective: Prioritize investments with a long-term horizon, such as PPF and NPS, for better returns.

- Tax-saving and Wealth Creation: Combine tax savings with wealth creation by investing in ELSS, which offers tax benefits along with potential capital appreciation.

- Start Early: Begin investing early to benefit from compounding returns and achieve your financial goals.

Understanding Tax-Saving Fixed Deposits

Tax-saving fixed deposits (FDs) offer a relatively secure investment option with tax benefits. Here’s what you need to know:

- Lock-in Period: These FDs typically have a lock-in period of five years.

- Interest Taxation: Interest earned is taxed as per your income tax slab.

- Suitability: Consider tax-saving FDs if you have a moderate risk appetite and prefer fixed returns over equity-linked options.

Other Tax-Saving Strategies

- House Rent Allowance (HRA): If you’re eligible for HRA, claim the maximum deduction by providing rent receipts and proof of rent paid.

- Medical Insurance: Opt for comprehensive health insurance plans to claim deductions under Section 80D.

- Home Loan Interest: Claim deductions on the interest component of your home loan under Section 24.

- Donations: Charitable donations can qualify for deductions under Section 80G.

- Consult a Tax Professional: For complex financial situations or to maximize tax savings, consider consulting a tax expert.

By following these tips and understanding the intricacies of the Income Tax Act, you can effectively plan your finances and reduce your tax liability. Remember, tax laws are subject to change, so it’s essential to stay updated and consult with a tax professional for personalized advice.

Conclusion

The main point of the article is to explain the concept of tax, the recent reforms in tax laws, and the impact of these reforms on individuals and businesses. It also provides information on income tax, tax slabs, deductions, and strategies for saving tax legally. The key takeaway is that understanding tax laws and recent reforms is crucial for financial planning, and effective tax planning can significantly reduce tax liability and help achieve financial goals.