You ever stare at your portfolio after a red day and whisper—“maybe I should’ve just bought gold like my mom said”? Yeah, same. But then you see Adani Net Worth 2025 trending again, and suddenly, your minor portfolio pain feels like a mosquito bite compared to the financial thunderstorms billionaires ride through.

Because let’s be honest—none of us have seen the kind of volatility Gautam Adani has lived through. Imagine watching billions vanish from your name faster than crypto influencers launching new tokens—only to recover it all within months. Meanwhile, the rest of us are just trying to figure out how to afford paneer at ₹480 a kilo without declaring bankruptcy.

That’s not investing. That’s a high-speed, no-seatbelt financial rollercoaster—and somehow, Adani’s still smiling at the end of the ride.

So, let’s pour a cup of strong, unsweetened chai and unpack how Gautam Adani pulled off one of the most jaw-dropping comebacks in Indian business history. From market meltdowns to billionaire rebounds, here’s the 2025 breakdown of Adani’s net worth, what’s fueling his empire, and maybe—just maybe—what regular folks like us can learn while nervously checking our demat apps at 2 a.m.

Adani’s Net Worth in 2025

As of October 2025, Gautam Adani’s net worth sits around $92.1 billion (that’s roughly ₹7.68 lakh crore for those of us measuring money in “how many flats could that buy in Gurugram”).

According to Bloomberg’s billionaire index, that puts him just one cup of espresso shy of Mukesh Ambani’s net worth—$95.8 billion.

Not bad for a guy who started out sorting diamonds and now runs everything from ports to power plants to airports. Meanwhile, I’m over here celebrating when my mutual fund gives a 10% return.

| Year | Net Worth (USD) | Global Rank | Change (%) |

|---|---|---|---|

| 2021 | $55B | 14th | — |

| 2022 | $125B | 2nd | +127% |

| 2023 | $60B | 20th | -52% |

| 2024 | $78.5B | 15th | +30% |

| 2025 | $92.1B | 12th | +17% |

The man’s net worth graph looks like a heart monitor after three espressos—spikes, crashes, recoveries. But hey, that’s the game when your portfolio moves with the markets.

Year-by-Year: Adani’s Wild Financial Ride

2020–21 was his breakout act. Renewable energy was the next big thing, and Adani was all-in—solar farms, wind projects, you name it.

Then came 2022, when he became the world’s second-richest man. For a minute there, Twitter thought he’d buy the moon next (or maybe Jet Airways).

2023? Well, that was the year every investor meme page came alive. The Hindenburg report dropped like a Netflix documentary twist, Adani stocks nosedived, and billions in paper wealth vanished. You could almost hear the collective “ouch” from Dalal Street to Wall Street.

By 2024 and now 2025, though? The man is back in business—literally. Debt reduction, investor confidence, and a green-energy comeback put his empire back on the billionaire map.

Moral of the story? You don’t panic-sell when billionaires don’t.

Where Adani’s Billions Actually Come From

Let’s peel the onion (carefully, before inflation makes us cry again). Adani’s fortune isn’t just in one company—it’s a web of power, ports, and some good ol’ diversification magic.

| Company | Sector | Approx. Stake | Contribution |

|---|---|---|---|

| Adani Enterprises | Infrastructure & Trading | ~63% | ₹2.1 lakh crore |

| Adani Ports | Logistics | ~66% | ₹1.6 lakh crore |

| Adani Green Energy | Renewables | ~56% | ₹1.8 lakh crore |

| Adani Power | Energy | ~75% | ₹1.1 lakh crore |

| Adani Total Gas | Energy Distribution | ~37% | ₹0.8 lakh crore |

| Adani Wilmar | FMCG | ~43% | ₹0.5 lakh crore |

See that? A classic portfolio that screams “don’t put all your eggs in one basket.” My only basket right now is an Amazon cart I can’t afford to check out, but still—lesson noted. And, If you’re interested in exploring low-priced Adani stocks, take a look at this guide: Adani Group Penny Stocks List. It’s a goldmine for investors who prefer to start small but think big.

Why His Net Worth Fluctuates So Wildly

Here’s the thing: when you’re sitting on billions tied to stock performance, your wealth can swing harder than Dogecoin on a Monday.

- Stock Valuations: The man’s net worth is basically an index fund with a face.

- Politics & Policy: A single regulation tweak and boom, headlines everywhere.

- Debt Management: Expansion’s fun until the interest payments come due.

- Global Energy Prices: Oil up? Coal down? Green energy up again? Adani’s wealth dances to that tune.

So yeah, next time your portfolio dips 3%, just remember—Adani’s dropped 50% and still came back. That’s perspective.

Adani vs Ambani: India’s Billionaire Face-Off

We love a good rivalry, don’t we? Coke vs Pepsi, Android vs iPhone, Ambani vs Adani.

Right now, Ambani leads by a small margin—roughly $3.7 billion—but Adani’s renewable push could flip the scoreboard any month.

| Billionaire | Net Worth (USD) | Main Business | Rank |

|---|---|---|---|

| Mukesh Ambani | $95.8B | Oil, Telecom, Retail | 11th |

| Gautam Adani | $92.1B | Infrastructure, Energy | 12th |

Both are betting big on India’s growth. One’s wiring your internet; the other’s building the roads and ports to move your data’s hardware. Symbiotic, isn’t it?

Meanwhile, in Billionaire Land…

Adani currently sits around 12th globally, rubbing shoulders with Larry Page and Sergey Brin. And while we’re watching crypto prices drop like mangoes in monsoon season, the Adanis and Ambanis of the world are quietly reshaping energy and infrastructure.

Sometimes I wonder—do billionaires also check their portfolio apps before bed, or just their Forbes ranking?

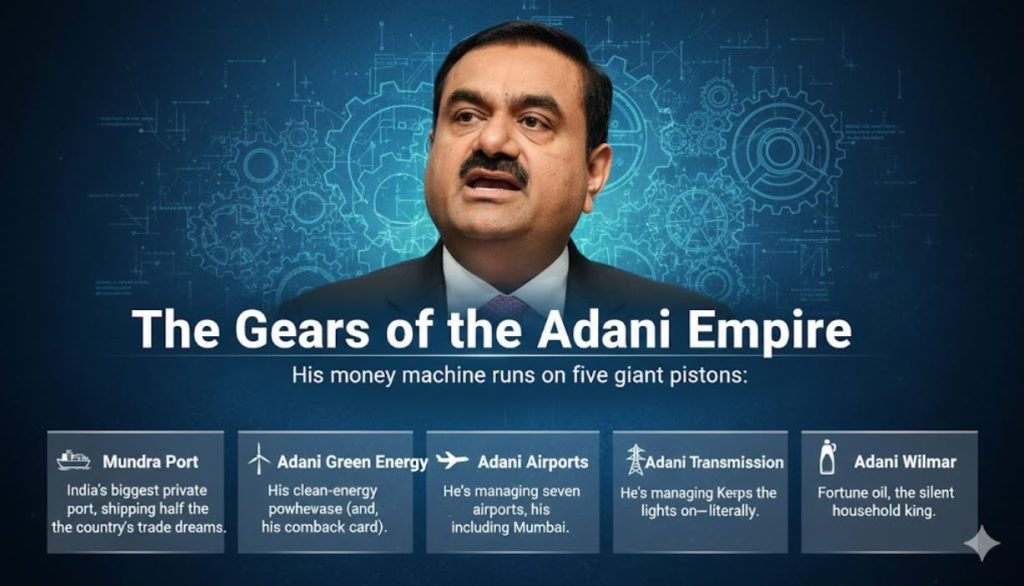

The Gears of the Adani Empire

His money machine runs on five giant pistons:

- Mundra Port: India’s biggest private port, shipping half the country’s trade dreams.

- Adani Green Energy: His clean-energy powerhouse (and, frankly, his comeback card).

- Adani Airports: He’s managing seven airports, including Mumbai.

- Adani Transmission: Keeps the lights on—literally.

- Adani Wilmar: Fortune oil, the silent household king.

That’s what I call diversification done right. Meanwhile, I can’t even diversify my weekend plans.

What’s New in 2025 (Because the News Never Sleeps)

- Adani Green Energy is launching another ₹40,000 crore solar expansion (sun’s the limit).

- Adani Ports posted record profits—exports are booming again.

- Investors who once ghosted after 2023 are now swiping right on Adani stocks.

- Oh, and there’s talk of Adani Enterprises entering the EV charging space. Elon, are you watching?

Inflation might be eating my grocery budget, but Adani seems to be eating markets for breakfast.

Quick Recap (Because TL;DR Is Real)

| Year | Net Worth (USD) | Rank | Change |

|---|---|---|---|

| 2021 | $55B | 14th | — |

| 2022 | $125B | 2nd | +127% |

| 2023 | $60B | 20th | -52% |

| 2025 | $92B | 12th | +53% |

A Few Thoughts Before You Scroll Away

Look, money doesn’t grow on trees—but if you’re Gautam Adani, it might grow near a solar farm or a shipping dock.

For the rest of us mere mortals, his story’s a pretty solid reminder to:

- Diversify your portfolio (seriously).

- Think long-term (don’t panic when the market sneezes).

- Watch sectors that actually build things—energy, infra, renewables.

And maybe, just maybe, keep one eye on your spending next time you open Swiggy. Inflation’s real, my friend.

Anyway, enough ranting. I’m off to refill my coffee and pretend my SIP is secretly compounding like Adani’s fortune.

If you liked this breakdown, share it with that one friend who says “the market’s too risky.” Because hey, so is life—and yet here we are, still investing.

For more insights on Indian markets, billionaire wealth updates, and stock analysis, stay tuned to SGXNifty.xyz — your daily pit stop for sharp, reliable market stories.