The Aadhaar-PAN linking deadline has been extended by three months from March 31 to June 30, 2023, by the government.

Linking your Aadhaar card with PAN card is a simple process and can be done in multiple ways. Here is a step-by-step guide on how to link Aadhaar with PAN Card.

Method 1: PAN Aadhar Link through the Income Tax e-filing website

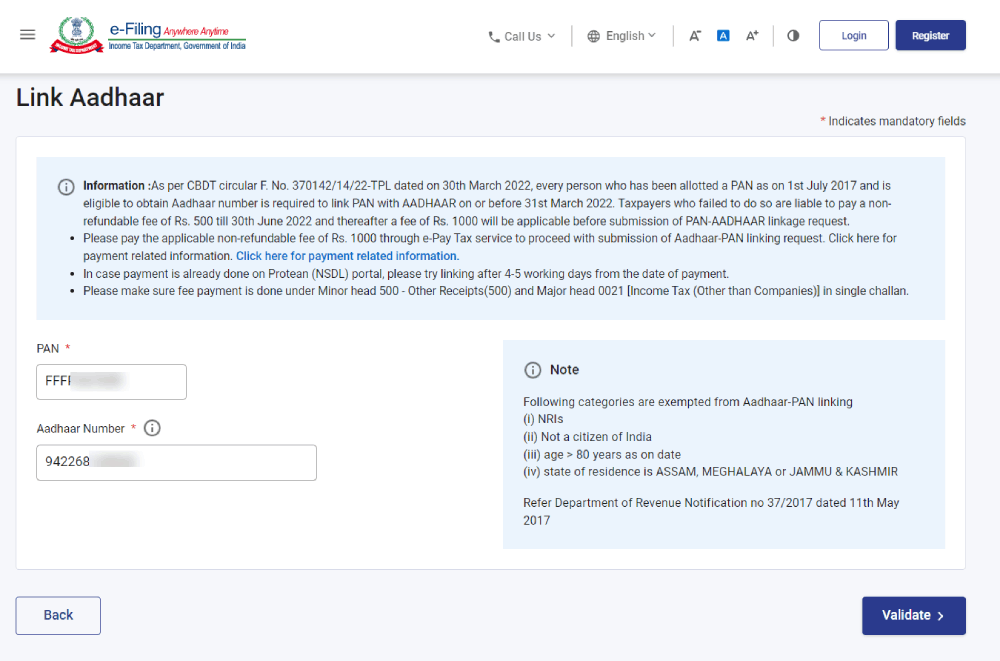

Visit the official income tax e-filing website: https://www.incometax.gov.in/iec/foportal/

Click on the “Link Aadhaar” option under the “Quick Links” section on the left-hand side of the page.

Enter your PAN number, and Aadhaar number then click on Validate.

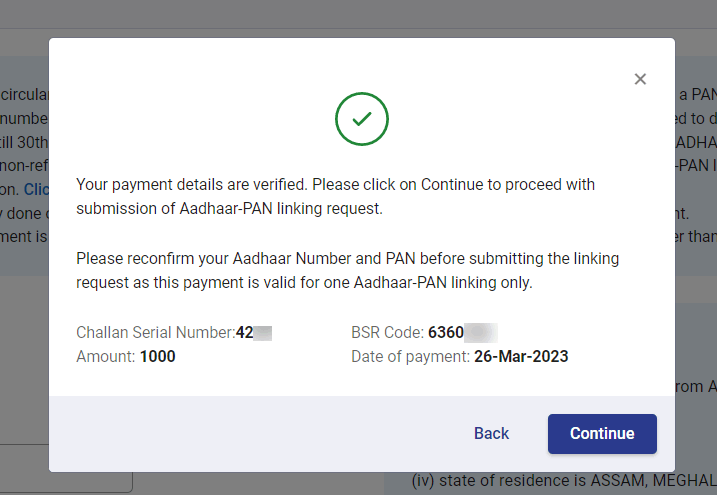

A pop-up will come up, saying your payment details verified if you have already paid the penalty of Rs.1000. if you have not paid penality, it will ask you to pay penality first, know here How to Pay Rs. 1000 Penalty to Link Aadhaar with PAN?

in this guide, we have already paid the fine, so we will move further by clicking on Continue.

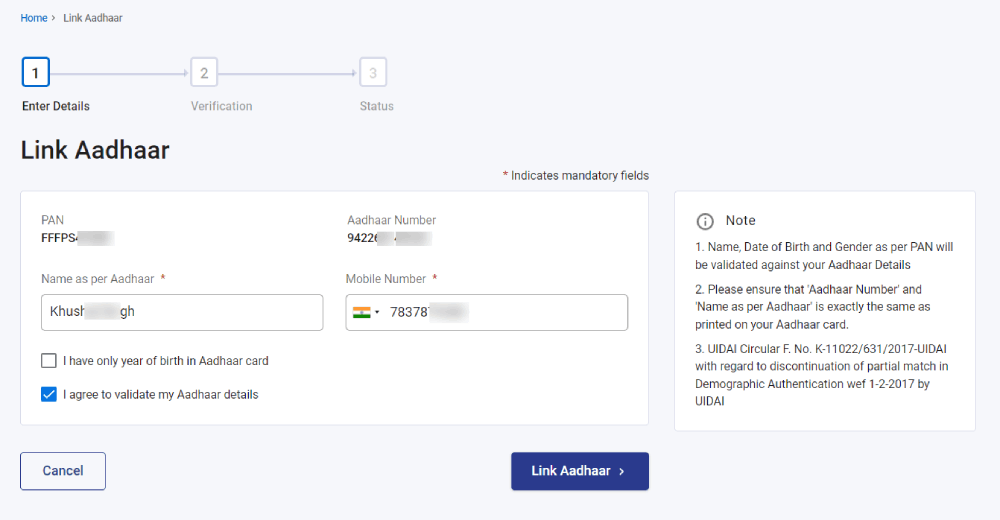

Check the “I have only year of birth in Aadhaar card” box only if you have only the year of birth mentioned in your Aadhaar card and not the date of birth. and check on I agree to validate my Aadhar details and then click on Link Aadhar Button.

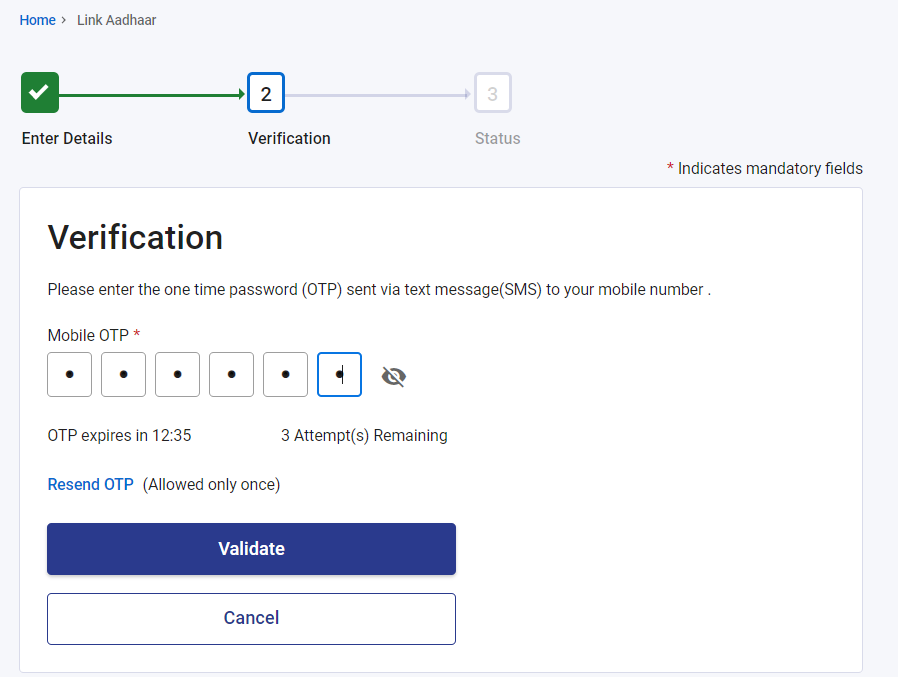

You will get an OTP on the number you have filled in, enter the OTP and click on Validate.

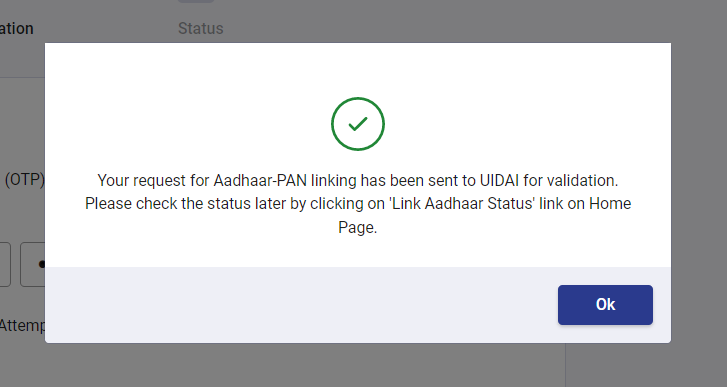

A popup will come stating “Your request for Aadhaar-PAN” linking has been sent to UIDAI for validation. You check “Link Aadhaar Status” after a few days.

Method 2: Aadhar PAN Card link through SMS

Type UIDPAN<SPACE><12 digit Aadhaar number><SPACE><10 digit PAN number> on your mobile phone.

Send the SMS to 567678 or 56161 from your registered mobile number.

Your Aadhaar and PAN card will be linked if the details entered by you match the details present in the Aadhaar card.

Once the process is done, You can check “Link Aadhaar Status” after a few days.