Even for people who have been investing for a long time, the stock market can be hard to understand and difficult to navigate. Many experts say that books are a good way to learn more about the stock market and how to make smart investments and help you find your way around. In this article, we’ll look at the Best 8 Books for Learning Stock Market for people who want to invest in the stock market. We’ll look at both old and new books. Whether you’re a new or experienced investor, these books can help you make the most of your money on the stock market by giving you tips, strategies, and ideas.

So, let’s get right into our 8 best books for learning the stock market that can help you learn more about the stock market and make better investment choices.

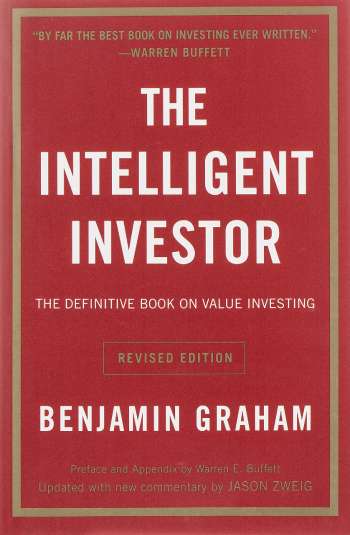

1. The Intelligent Investor by Benjamin Graham

“The Intelligent Investor” by Benjamin Graham is a timeless classic that you should read if you’re interested in investing. Many people think that this book, which came out in 1949, is one of the most important books ever written about investing. The book is split into three parts. The first part is about the ways that bullish investors make investments, the second part is about how markets work, and the third part is about different ideas related to risk management. Overall, “The Intelligent Investor” is a book that everyone who wants to learn more about value investing and the stock market should read.

One of the most prominent instances of the success of the principles stated in this book is Warren Buffet, the most successful investor of our time, who built his own investment strategy using Graham’s lessons.

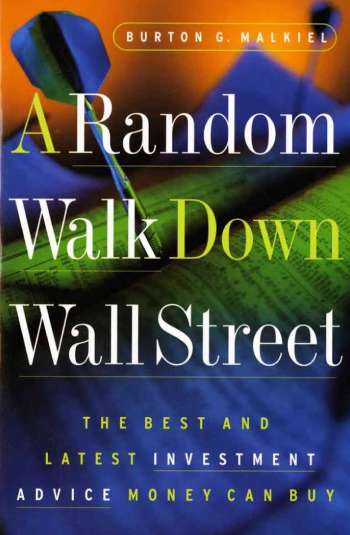

2. A Random Walk Down Wall Street by Burton Malkiel

Burton Malkiel’s “A Random Walk Down Wall Street” is a must-read. This book, which came out for the first time in 1973, is a reliable guide to a wide range of investment strategies and ideas. The efficient market hypothesis is one of Malkiel’s main ideas. It says that stock prices move in a way that is similar to a random walk, making it almost impossible to predict how they will move.

Malkiel presents an excellent rationale for why picking stocks and timing the market will probably not give you better returns than a simple, passive way to invest. He instead recommends a low-cost, long-term investment plan that focuses on diversification and index funds. He also gives a detailed fundamental and technical analysis of stocks, bonds, and mutual funds, among other ways to invest.

The book is written in a way that makes it easy for both new and experienced investors to understand. Malkiel uses stories and examples from real life to show his points and make hard ideas about investing easier to understand. “A Random Walk Down Wall Street” is a must-read for anyone who invests, whether it’s their first time or they’ve been doing it for years. It can help you make smart investment decisions and understand the ups and downs of the stock market.

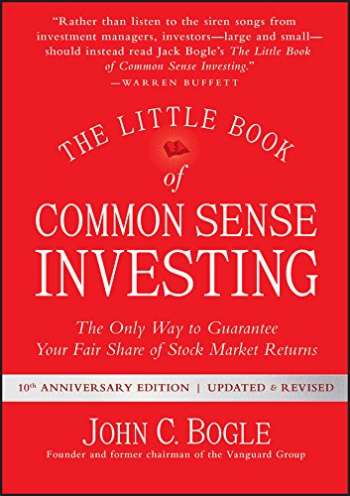

3. The Little Book of Common Sense Investing” by John C. Bogle

Go no farther than John C. Bogle’s “The Little Book of Common Sense Investment” if you’re searching for a no-nonsense approach to investing that truly works. As the famed founder of mutual funds, Bogle is well-versed in long-term wealth accumulation. His secret? Low-cost index funds.

Bogle explains the simplest and most successful investing plan for attaining your financial objectives in this classic book: buy and hold a mutual fund that follows a broad stock market index, such as the S&P 500. Although the stock market has seen ups and downs since the book’s first publication in 2007, Bogle’s investing concepts have remained rock-solid.

Follow Bogle’s advice and put most of your money into low-cost index funds if you want to make sure you get your fair share of stock market returns. With “The Little Book of Common Sense Investing” as your guide, you’ll be well on your way to building a strong financial future.

4. The Black Swan by Nassim Nicholas Taleb

Nassim Nicholas Taleb, who used to trade options, wrote an interesting book called The Black Swan: The Impact of the Highly Improbable. The Black Swan theory, which is what Taleb calls the idea of rare and unpredictable outlier events and how people tend to oversimplify and explain them after the fact, is explored in the book. The book talks about a lot of different things, like knowledge, art, and ways of life. To explain his ideas, the author uses stories and fictional elements. The book has been a huge hit, staying on the New York Times best-seller list for 36 weeks.

Taleb has spent years studying how people often trick themselves into thinking they know more than they do. He says that we tend to worry about things that don’t matter, while important things keep happening that surprise us and change our world. In this groundbreaking book, Taleb shows how little we know about what we don’t know and gives easy ways to deal with and even benefit from “black swan” events. The Black Swan is beautiful, shocking, and useful everywhere. It will change the way you see the world. Taleb’s writing style is funny and irreverent, and he knows a lot about a wide range of topics, from cognitive science to business to probability theory. This makes for a fun and interesting book to read. This book is a milestone and a black swan in its own right.

5. Encyclopedia of Chart Patterns by Thomas Bulkowski

Thomas Bulkowski’s Encyclopedia of Chart Patterns is an important book for anyone who wants to learn more about technical analysis of the stock market. The book talks about more than 50 chart patterns, some of which are well-known and some of which are not. For each pattern, the book gives a detailed analysis and statistics. This book is a must-read for traders and investors because of Bulkowski’s thorough research and analysis of chart patterns over a 10-year period.

The book is well-organized, with each chart pattern presented in a clear, simple manner. Bulkowski defines each pattern, includes identification rules, performance data, trading techniques, and example charts. The book also contains chapters on trade setups, event patterns, and market indicators, giving readers a comprehensive technical analysis arsenal.

One of the best things about the Encyclopedia of Chart Patterns is that the author spent a lot of time studying chart patterns and writing about them. Bulkowski has looked at thousands of charts to figure out how likely each pattern is to work. This gives traders a quantitative way to decide what to do when trading. There are a lot of charts and tables in the book that give useful information about how each pattern works. This makes it easy for readers to compare and contrast different patterns.

You can watch SGX Nifty candlestick chart on the go

6. The Warren Buffett Way by Robert G. Hagstrom

The Warren Buffett Way is a classic book on investing that explains in detail and with great insight how one of the most successful investors of all time, Warren Buffett, made his money. The book, which was written by Robert G. Hagstrom, looks at the principles and methods that have made Buffett one of the most successful investors in history, as well as how individual investors can use these strategies in their own portfolios.

The book is written in a clear and interesting way and has a lot of useful information and advice for investors of all skill levels. Hagstrom talks about things like value investing, analyzing the market, analyzing financial statements, and managing risks, all of which are important for investing success.

One of the best things about The Warren Buffett Way is that it explains in detail how Buffett thinks about investing and how he chooses stocks that will do well. The book gives many examples of successful investments that Buffett has made and explains in detail how he analyzes and decides which companies are undervalued.

Overall, The Warren Buffett Way is a must-read for anyone interested in investing or seeking to improve their investment strategies.

7. One Up On Wall Street by Peter Lynch

In this landmark investing book, One Up On Wall Street, Lynch outlines his investment philosophy and urges individual investors to utilize their unique insights and skills to identify profitable investment opportunities in firms they understand.

Lynch highlights the importance of doing extensive study before to investing in any firm, and supports a long-term investment strategy. He thinks that investment possibilities are abundant and may be discovered in common locations such as grocery stores and workplaces. The challenge is to find these firms before expert analysts uncover them.

Under Lynch’s direction, readers will learn how to leverage their own expertise to outperform pros in the financial industry. This book gives vital knowledge on how to make educated investing choices and construct a long-term portfolio, regardless of your experience as an investor.

8. How to Make Money in Stocks: A Winning System in Good Times and Bad by William J. O’Neil

This book presents readers with a tested and successful investing method that the author himself has utilized to attain market success.

O’Neil’s investing approach, known as the CAN SLIM technique, is built on a set of fundamental and technical characteristics that he feels are critical for spotting great investment opportunities. To select equities with the potential for high returns, the technique considers characteristics such as earnings growth, institutional ownership, and market movements.

One of the best reasons to read this book is that it was written by a successful investor who has used his own investment strategy to make a lot of money. O’Neil started the newspaper Investors Business Daily, which has become a trusted place for both individual investors and professional fund managers to get information about investments.

O’Neil uses his wealth of knowledge and expertise in this book to teach readers how to make educated investing choices and develop a lucrative portfolio. The book is packed with practical information and real-world examples, making it suitable for both rookie and experienced investors.

Another reason to read this book is that it takes a comprehensive approach to investing, stressing the value of both fundamental and technical analysis. O’Neil demonstrates how to utilize these two forms of research to uncover great investment possibilities and make educated judgments based on market trends and individual company performance.

Conclusion:

In our article, we have compiled a list of the 8 best books for Learning Stock Market. These books offer valuable insights and information that can help you gain a deeper understanding of how the stock market works. We have carefully selected the top three picks that we believe are essential reads for anyone who wants to expand their knowledge in this field.