The Powerful Morning Star Candle Pattern (The Ultimate Guide) explains one of the most effective bullish reversal signals that appears at the end of a downtrend, signaling a potential shift in control from sellers to buyers.

This comprehensive guide delves deep into the intricacies of the Morning Star pattern.

We’ll go beyond the basic definition, exploring how to accurately identify it on your charts, develop effective trading strategies around it, understand its psychological underpinnings, and combine it with other powerful technical analysis tools.

Whether you’re a budding trader eager to learn or a seasoned professional looking to refine your edge, mastering the Morning Star can significantly enhance your ability to spot and profit from bullish reversals.

Powerful Morning Star Candle Pattern?

A Three-Act Play of Bullish Revival

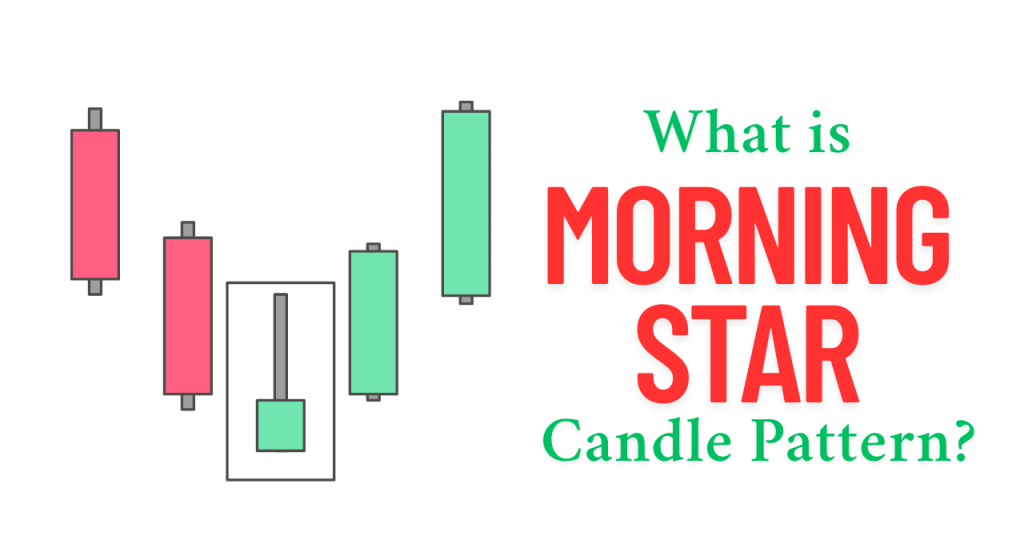

The Morning Star isn’t just a random sequence of candlesticks; it’s a visual narrative unfolding over three distinct trading periods, depicting a potential change in market leadership:

The Long Bearish Candle: The Reign of the Sellers (Act I):

The first candle in the Morning Star formation is a substantial red (or black) candlestick that firmly continues the prevailing downtrend.

Its large body signifies strong selling pressure and reinforces the existing bearish sentiment. This candle paints a picture of sellers firmly in control.

The Small-Bodied Candle: Indecision and a Glimmer of Hope (Act II):

The second candle is characterized by its small body, which gaps down from the close of the first bearish candle.

The color of this candle (red or green) is less significant than its diminutive size, indicating a period of indecision in the market.

Often appearing as a Doji (open and close prices are nearly identical) or a Spinning Top (small body with noticeable upper and lower wicks), this candle signals a weakening of the prior strong selling momentum and the emergence of uncertainty.

The gap down is a crucial element, signifying a break from the continuous downward pressure.

The Strong Bullish Candle: Buyers Seize Control (Act III):

The final act of the Morning Star is a significant green (or white) candlestick that opens at or below the low of the second candle and closes decisively within the body of the first red candle.

Ideally, this bullish candle closes above the midpoint of the first candle, demonstrating a strong resurgence of buying pressure and a potential takeover by the bulls.

The substantial body and strong upward movement provide compelling evidence of a shift in momentum and a likely trend reversal.

If you’re new to candlestick trading or want to strengthen your foundation, don’t miss our detailed guide on the Hammer Candlestick Pattern (Bullish Reversal) — another classic bullish reversal formation that can work well alongside the Morning Star setup.

Decoding the Market Psychology

Understanding the Morning Star’s Signal

The Morning Star pattern offers a fascinating glimpse into the evolving psychology of market participants:

- Bearish Exhaustion: The initial long red candle represents the continuation of the established downtrend, often fueled by fear and continued selling pressure.

- Seller Uncertainty: The gapping down and small body of the second candle indicate that sellers are losing conviction and are unable to push prices significantly lower. This pause creates an opportunity for buyers to contemplate entering the market.

- Buyer Aggression: The strong green candle signifies that buyers have stepped in with significant force, overpowering the sellers and driving prices upward. This decisive move suggests a change in sentiment and the potential for further upward momentum.

Identifying the Morning Star

Key Characteristics to Look For on Your Charts

Accurate identification is the first step towards successfully trading the Morning Star. Look for these key characteristics:

- Preceding Downtrend: The pattern must form at the culmination of a clear and established downtrend. Without a prior downtrend, it cannot be considered a reversal signal.

- Significant Bearish Candle: The first candle should be a relatively large red (or black) candle, indicating strong initial selling pressure.

- Gapped-Down Indecision: The second candle must have a small body and gap down below the closing price of the first candle. This gap signifies a break in the downward momentum.

- Powerful Bullish Reversal: The third candle should be a substantial green (or white) candle that closes significantly into the body of the first red candle (ideally above the midpoint). This demonstrates strong buying pressure.

- Volume Confirmation (Highly Recommended): While not strictly part of the pattern definition, increased volume on the third bullish candle adds significant conviction to the reversal signal. Higher buying volume confirms the strength of the bullish momentum.

To help build a visual memory of various formations including the Morning Star, we recommend downloading our All Candlestick Patterns PDF Download — a practical reference guide for traders of all levels.

How To Trade Powerful Morning Star Candle Pattern (The Ultimate Guide)?

Strategic Entry, Exit, and Risk Management

Once you’ve confidently identified a Morning Star pattern, here’s a strategic approach to trading it effectively:

- Pattern Recognition: Diligently scan your charts for the specific three-candle formation meeting all the criteria outlined above, appearing at the end of a discernible downtrend.

- Confirmation is Key: While the Morning Star itself is a strong signal, waiting for additional confirmation can increase the probability of a successful trade. Look for:

- The strength and size of the third bullish candle.

- Increased trading volume on the third candle.

- Other technical indicators turning bullish (e.g., a bullish crossover on the MACD, the RSI breaking above 50, price breaking above a short-term downtrend line).

- Strategic Entry: Consider entering a long position at the close of the third bullish candle. This confirms the completion of the pattern and the initial bullish move. More conservative traders might wait for a slight pullback after the third candle confirms support before entering.

- Prudent Stop-Loss Placement: Protecting your capital is paramount. Place your stop-loss order just below the low of the second (indecision) candle. This level acts as a critical support; if the price breaks below it, the bullish reversal scenario is likely invalidated.

- Setting Realistic Take-Profit Targets: Define your profit targets based on sound technical analysis and your risk-reward ratio. Consider the following:

- Key Resistance Levels: Identify previous highs or significant resistance zones where the price might encounter selling pressure.

- Risk-Reward Ratio: Aim for a minimum risk-reward ratio of 1:2 (your potential profit is at least twice the amount you are risking). A ratio of 1:3 or higher is often preferred.

- Fibonacci Extension Levels: Utilize Fibonacci extension tools to project potential price targets based on the preceding downtrend.

- Trendline Breaks: If the downtrend was defined by a trendline, a break above that trendline after the Morning Star formation can provide an additional confirmation and a potential target.

Enhancing Your Analysis

Related Candlestick Patterns to Watch

Understanding related candlestick formations can provide valuable context and strengthen your analysis when you encounter a Morning Star:

- Evening Star (Bearish Reversal): The bearish counterpart of the Morning Star, appearing at the peak of an uptrend and signaling a potential bearish reversal. Recognizing both patterns allows for a more balanced understanding of potential trend changes.

- Bullish Engulfing Candle: A two-candle bullish reversal pattern where a large green candle completely engulfs the previous red candle. While also bullish, it lacks the indecision gap of the Morning Star, suggesting a more immediate and forceful reversal.

- Doji and Spinning Top Candles: These small-bodied candles frequently form the central “star” of the Morning Star, emphasizing the period of market indecision before the bullish surge. Recognizing these candles in other contexts can also provide valuable insights into potential turning points.

- Individual Red and Green Candles: A solid understanding of the basic implications of individual bearish (red) and bullish (green) candles forms the foundation for interpreting all multi-candle patterns, including the Morning Star.

For those looking to broaden their pattern recognition and improve trade timing, our breakdown of the Inside Candle Pattern: A Guide to Smart Trading offers actionable insights.

Navigating the Pitfalls

Limitations and Common Mistakes to Avoid

While the Morning Star is a powerful tool, it’s essential to be aware of its limitations and avoid common trading errors:

- False Signals in Low Liquidity: In markets with low trading volume, candlestick patterns, including the Morning Star, can produce unreliable signals. Ensure sufficient volume accompanies the pattern, especially on the confirming bullish candle.

- Ineffectiveness in Sideways Markets: The Morning Star is a reversal pattern and is most effective when it appears after a clear and defined downtrend. In sideways or range-bound markets, it may generate false signals as there is no established trend to reverse.

- Ignoring the Broader Context: Never trade the Morning Star in isolation. Always consider the overall market sentiment, prevailing trends on higher timeframes, and any relevant economic news or events that might influence price action.

- Rushing the Entry: Wait for the complete formation of the three-candle pattern and ideally for confirmation before entering a trade. Entering prematurely can lead to being caught in a false move.

- Improper Stop-Loss Placement: Placing your stop-loss too close to the entry point increases the risk of being stopped out prematurely due to normal market fluctuations. Placing it too far exposes you to excessive risk.

- Ignoring Risk-Reward: Always define your take-profit targets and ensure a favorable risk-reward ratio before entering a trade.

While the Morning Star is a reliable signal in many cases, it’s not foolproof. Traders should always consider market context and confirm patterns with other tools. For a broader perspective on technical analysis mistakes to avoid, you can check Investopedia’s guide to common trading mistakes.

Why the Morning Star Matters

A Fusion of Price Action and Market Sentiment

The Morning Star pattern holds significant value for traders because it provides more than just a visual representation of price movements. It offers crucial insights into the underlying dynamics of market sentiment:

- Visual Confirmation of Momentum Shift: The pattern clearly illustrates the transition from strong bearish momentum to increasing bullish control, providing a visual cue for a potential trend change.

- Identification of Potential Lows: When appearing after a substantial downtrend and often near key support levels, the Morning Star can help traders identify potential bottoming formations and areas where buying interest is likely to emerge.

- Defined Trading Levels: The structure of the pattern provides logical levels for trade entry (after the third candle), stop-loss placement (below the second candle’s low), and potential profit targets based on subsequent price action and resistance levels.

- Synergy with Other Technical Tools: The effectiveness of the Morning Star is amplified when used in conjunction with other technical indicators, such as oscillators (RSI, Stochastic), momentum indicators (MACD), and trend-following tools (Moving Averages).

Integrating Powerful Morning Star Candle Pattern

Combining the Morning Star with a Robust Trading Strategy

To maximize the potential of the Morning Star pattern, consider integrating it into a comprehensive trading strategy that includes:

- Thorough Trend Analysis: Always analyze the prevailing trend on multiple timeframes before looking for reversal patterns. The Morning Star is most significant when it appears at the end of a clear downtrend on a higher timeframe.

- Key Support and Resistance Levels: Look for Morning Star formations occurring near significant support levels. This confluence of signals increases the probability of a successful reversal.

- Volume Confirmation: Pay close attention to trading volume. A Morning Star accompanied by increasing volume on the bullish confirmation candle provides a stronger signal.

- Oscillator Divergence: Look for bullish divergences on oscillators like the RSI or MACD that precede or coincide with the Morning Star pattern. This can indicate weakening bearish momentum and a higher likelihood of a reversal.

- Moving Average Crossovers: Observe how the price interacts with key moving averages. A Morning Star forming near a long-term moving average or preceding a bullish moving average crossover can strengthen the bullish outlook.

Final Thoughts

The Morning Star candlestick pattern is a powerful and reliable indicator of potential bullish reversals when identified correctly and traded strategically.

By understanding its formation, recognizing its key characteristics, and integrating it with a well-defined trading plan that includes sound risk management, you can significantly enhance your ability to capitalize on trend changes in the financial markets.

Remember that no single pattern guarantees profits, so always combine your candlestick analysis with a comprehensive understanding of market context and utilize confirmation tools to increase the probability of successful trades.

With consistent practice and disciplined application, mastering the Morning Star can become a valuable asset in your trading toolkit, illuminating potential pathways to profitable opportunities.